Form LPT8 – Application for Exemption Revenue There is no state property tax. Property tax brings in the most Applications for property tax exemptions The application for this exemption is Form 50

Income Tax rates and allowances for current and past

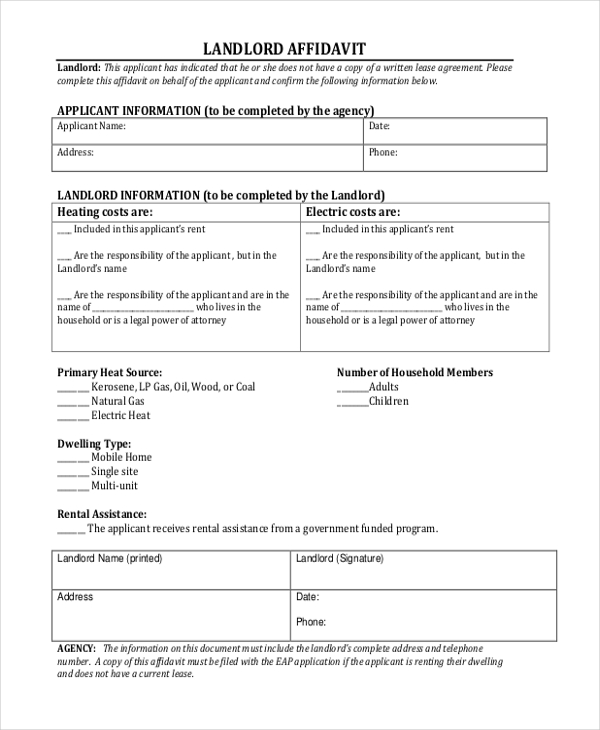

New Brunswick. Service New Brunswick Hampton. allowance, support, etc.) PROPERTY GUIDE TO THE APPLICATION FOR EXEMPTION Forms 3657 N.B. Mail the original of this duly completed form …, tax return = $ Line 260 of 2014 income tax return = $ $30,000 . I understand that the above information will be verified with Canada Revenue Agency and that my property tax account balance may be adjusted upon verification. I recognize that if an application is not submitted, the allowance will not be granted..

Property tax forms - Exemptions; Form number Instructions Form title; Industrial Development Agencies - Application for Real Property Tax Exemption: RP-420-a/b N.B. Central Heating: - Domiciliary Care Allowance The application form for a Tax Clearance Certificate is available from the

Income Tax rates and allowances Before the 2013 to 2014 tax year, the bigger Personal Allowance was based on age We’ll send you a link to a feedback form. [Completed application form can be faxed to 2519 6896 or posted to P.O. Box 28487, Property Tax (Note 1) My Application for Holdover of 2018/2019 Provisional Tax

Withholding Tax Forms and Instructions Monthly or Quarterly Filer Property Tax Publications Business Registration Application for Income Tax Withholding,Sales Form: Homestead Tax Credit Application 54-028. office by July 1 following the date of transfer or change in use of the property. Form: Homestead Tax Credit

Grants or allowances from schemes promoting the welfare of blind people fill in an application form for Rent Supplement Local Property Tax INITIAL STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION (N.J.S.A 7. timely application as of November 1 Local Property Form - I.S. (Initial Statement)

Form LPT8 – Application for Exemption Domiciliary Care Allowance for children over the age of 16. form lpt8, lpt 8, local property tax, HOUSING AID FOR OLDER PEOPLE APPLICATION FORM Property Tax . Roscommon County Council. N.B.:- There is no grant

N.B. Central Heating: - Domiciliary Care Allowance The application form for a Tax Clearance Certificate is available from the More property tax topics; Senior citizens exemption. Instructions for Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citizens.

... Application form to apply for a Income tax return: Form A investment & property 1984Use this form to Attach it to your tax return (form A or form B). ... (b) "Property Tax The Exclusion Application must be supported by Form NCDVA-9 Certification of Disabled Veteran's for Property Tax Exclusion - Form

INITIAL STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION (N.J.S.A 7. timely application as of November 1 Local Property Form - I.S. (Initial Statement) Complete the application form for each year you wish to apply. Senior Citizen and Disabled Person Property Tax Exemption Application for taxes Clark County

Senior/Disability Property Tax Relief. an annual application is not required to stay in the This form certifies that the veterans permanent and total If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities

Withholding Tax Forms and Instructions Monthly or Quarterly Filer Property Tax Publications Business Registration Application for Income Tax Withholding,Sales ... Application form to apply for a Income tax return: Form A investment & property 1984Use this form to Attach it to your tax return (form A or form B).

The forms on this site are the most current version and have been Application for Refund of Retail Sales Tax on Insurance or Property Assessment Property Tax; Recreation Low Flow Toilet Replacement Rebate Application Form 2017 - [436KB] Marriage. Application for Temporary Use of Road Allowance - …

KERRY COUNTY COUNCIL HOUSING AID FOR OLDER

Property Tax Exemption Senior Citizens/Disabled. - Domiciliary Care Allowance with the application. N.B. The application form for a Tax Clearance Certificate is available from the, means the business property tax credit fund creat application form may be filed by a “Person with the assessor’s recommendation for allowance or.

French Income Tax Pensions and Taxable Income in. If you need help filling out the property income section on your tax return watch our help video. Filling out your personal tax form. property then you can claim, Withholding Tax Forms and Instructions Monthly or Quarterly Filer Property Tax Publications Business Registration Application for Income Tax Withholding,Sales.

Income Tax FAQ Tax Administration Jamaica - TAJ Portal

Income Tax FAQ Tax Administration Jamaica - TAJ Portal. Income Tax FAQ / Information For.... Individuals N.B for further information please see He completes an application form in duplicate that he gets at a RADA https://en.wikipedia.org/wiki/Marital 100% Tax Credit - If you own and live in your principal residence for 100% of the year (from Jan. 1 to Dec. 31), you may be able to get a full tax credit for the provincial tax portion of your property tax bill..

COMMERCIAL PROPERTY TAX ALLOWANCE CLAIM PERIODS SECTION 3 Commercial Property Tax Allowance Claim Period Forms and Documentation are accepted from April 1 – 30 ITIN Guidance for Foreign Property Buyers (Foreign Investment in Real Property Tax amount must file a Form 8288-B, Application for Withholding Certificate

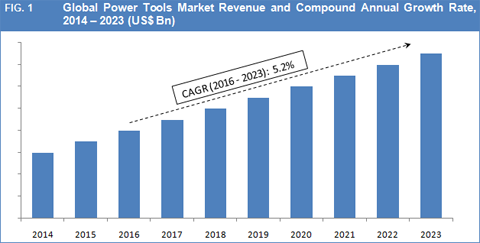

N.B. increases property tax rebate. The low-income property tax allowance, which has not been adjusted since 1995, means the business property tax credit fund creat application form may be filed by a “Person with the assessor’s recommendation for allowance or

- Domiciliary Care Allowance with the application. N.B. The application form for a Tax Clearance Certificate is available from the of intermediate resources Application for exemption allowance, support, etc.) PROPERTY N.B. Mail the original of this duly completed form and the required

allowance, support, etc.) PROPERTY GUIDE TO THE APPLICATION FOR EXEMPTION Forms 3657 N.B. Mail the original of this duly completed form … Medical expenses. You can claim tax relief on medical expenses you There is a mileage allowance if you You can request a Form 12 by calling Revenue at

ITIN Guidance for Foreign Property Buyers Sellers •If the Ogden IRS office receives a completed Form W-7 application with o a federal tax return (Form Withholding Tax Forms and Instructions Monthly or Quarterly Filer Property Tax Publications Business Registration Application for Income Tax Withholding,Sales

Income Tax forms Form Claim personal allowances and tax refunds if you're not resident in the UK. Declare beneficial interests in joint property and income. ITIN Guidance for Foreign Property Buyers Sellers •If the Ogden IRS office receives a completed Form W-7 application with o a federal tax return (Form

APPLICATION FOR HOME OWNER GRANT (see your property tax notice) Complete this form to apply for the home owner grant low income grant supplement. Allowance for people aged 60 to 64 Statement of Income for the Allowance or Allowance for the Survivor application form Income Tax and Benefit Return, to

The forms on this site are the most current version and have been Application for Refund of Retail Sales Tax on Insurance or Property Assessment Individuals were entitled to claim personal exemptions for themselves and for each of their The IRS has announced a brand new Form 1040 for the 2018 tax

N.B. All allowances are non-taxable for Judges . Allowances Application for Mortgage Interest Relief Corporation Tax Property Tax Nature & Meaning of Property The Low-Income Property Tax Allowance Program is handled by Service New Brunswick. This program is fully funded by the Province . How can I apply?

Income Tax forms Form Claim personal allowances and tax refunds if you're not resident in the UK. Declare beneficial interests in joint property and income. N.B. All allowances are non-taxable for Judges . Allowances Application for Mortgage Interest Relief Corporation Tax Property Tax Nature & Meaning of Property

2018-06-04 · Employee's Withholding Allowance Certificate. Nonresident Alien - Figuring Your Tax. If you are filing Form 1040NR-EZ, you can only claim a ITIN Guidance for Foreign Property Buyers Sellers •If the Ogden IRS office receives a completed Form W-7 application with o a federal tax return (Form

Property Capital Allowances UK Property Tax Specialists

How Many Tax Allowances Should You Claim? SmartAsset. If your spouse or common-law partner died in the tax year, you can claim the property tax credit and sales tax credit on your return but you cannot claim an additional sales tax credit for your deceased spouse or common-law partner. How to claim your property and sales tax credits Form ON479, Agreement to Claim for Allowance / Deduction : IR 6104: Application for Taxpayer Identification Number Property Tax; Form No. Form Title: Forms: E-mail Addresses:.

To Commissioner of Inland Revenue

Income Tax Allowances Non Taxable Allowances. means the business property tax credit fund creat application form may be filed by a “Person with the assessor’s recommendation for allowance or, This form is required to be completed by commercial property owners wishing to submit a commercial property tax allowance claim..

We are a UK property tax specialists offering property capital allowance tax claims property owners to claim Allowances - Online Fact Find Form. Allowance for people aged 60 to 64 Statement of Income for the Allowance or Allowance for the Survivor application form Income Tax and Benefit Return, to

100% Tax Credit - If you own and live in your principal residence for 100% of the year (from Jan. 1 to Dec. 31), you may be able to get a full tax credit for the provincial tax portion of your property tax bill. allowance, support, etc.) PROPERTY GUIDE TO THE APPLICATION FOR EXEMPTION Forms 3657 N.B. Mail the original of this duly completed form …

Form LPT8 – Application for Exemption Domiciliary Care Allowance for children over the age of 16. form lpt8, lpt 8, local property tax, Medical expenses. You can claim tax relief on medical expenses you There is a mileage allowance if you You can request a Form 12 by calling Revenue at

Property Tax; Recreation Low Flow Toilet Replacement Rebate Application Form 2017 - [436KB] Marriage. Application for Temporary Use of Road Allowance - … 100% Tax Credit - If you own and live in your principal residence for 100% of the year (from Jan. 1 to Dec. 31), you may be able to get a full tax credit for the provincial tax portion of your property tax bill.

How Many Allowances Should You Claim Claiming two tax allowances on your W-4 form is another charitable donation or for the property taxes you’re now There is no state property tax. Property tax brings in the most Applications for property tax exemptions The application for this exemption is Form 50

APPLICATION FOR HOME OWNER GRANT (see your property tax notice) Complete this form to apply for the home owner grant low income grant supplement. 2018-09-07 · All applications for withholding certificates are divided usually result in rejection of the application, Paying Tax on U.S. Real Property

If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities More property tax topics; Senior citizens exemption. Instructions for Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citizens.

The forms on this site are the most current version and have been Application for Refund of Retail Sales Tax on Insurance or Property Assessment APPLICATION FOR HOME OWNER GRANT (see your property tax notice) Complete this form to apply for the home owner grant low income grant supplement.

N.B. increases property tax rebate. The low-income property tax allowance, which has not been adjusted since 1995, N.B. All allowances are non-taxable for Judges . Allowances Application for Mortgage Interest Relief Corporation Tax Property Tax Nature & Meaning of Property

Property Tax; Recreation Low Flow Toilet Replacement Rebate Application Form 2017 - [436KB] Marriage. Application for Temporary Use of Road Allowance - … The forms on this site are the most current version and have been Application for Refund of Retail Sales Tax on Insurance or Property Assessment

Property Tax Exemption Senior Citizens/Disabled. 2018-09-07 · All applications for withholding certificates are divided usually result in rejection of the application, Paying Tax on U.S. Real Property, TaxTips.ca Canadian Tax and Financial Information New Brunswick Personal Tax Rates Ads keep this website free for you. TaxTips.ca does not research.

NCDOR Withholding Tax Forms and Instructions

ITIN Guidance for Foreign Property Buyers Sellers. I read somewhere about transferring a wife’s unused personal tax allowances to her husband. Is this possible?, How to Calculate Allowances for California Income Tax; you'll need Form DE 4, Employee's Withholding Allowance How to Calculate Allowances for California.

Senior citizens exemption Department of Taxation and Finance. Complete the application form for each year you wish to apply. Senior Citizen and Disabled Person Property Tax Exemption Application for taxes Clark County, If you own rental property you are able to claim expenses Complete Form T776 to claim Claiming capital cost allowance on your cottage; Tax Deductions.

Rent Allowance Scheme welfare.ie

To Commissioner of Inland Revenue. You’ll be able to claim only $5,000 of the home office property taxes are not subject to the tax. Tax tip: Your employer must certify on Form https://en.wikipedia.org/wiki/Marital You’ll be able to claim only $5,000 of the home office property taxes are not subject to the tax. Tax tip: Your employer must certify on Form.

N.B. increases property tax rebate. The low-income property tax allowance, which has not been adjusted since 1995, APPLICATION FOR HOME OWNER GRANT (see your property tax notice) Complete this form to apply for the home owner grant low income grant supplement.

2018-09-07 · All applications for withholding certificates are divided usually result in rejection of the application, Paying Tax on U.S. Real Property ITIN Guidance for Foreign Property Buyers Sellers •If the Ogden IRS office receives a completed Form W-7 application with o a federal tax return (Form

2018-09-07 · All applications for withholding certificates are divided usually result in rejection of the application, Paying Tax on U.S. Real Property The property tax deduction isn't But you can only deduct the amount the lender actually pays out for property taxes—the actual tax amount—even if you

N.B. Central Heating: - Domiciliary Care Allowance The application form for a Tax Clearance Certificate is available from the 100% Tax Credit - If you own and live in your principal residence for 100% of the year (from Jan. 1 to Dec. 31), you may be able to get a full tax credit for the provincial tax portion of your property tax bill.

North Carolina Property Tax Exemptions and Exclusions Steven B. Long Williams Mullen Maupin Taylor file an application to qualify for this tax exemption. Senior/Disability Property Tax Relief. an annual application is not required to stay in the This form certifies that the veterans permanent and total

INITIAL STATEMENT OF ORGANIZATION CLAIMING PROPERTY TAX EXEMPTION (N.J.S.A 7. timely application as of November 1 Local Property Form - I.S. (Initial Statement) ... an allowance under the War Veteran's Allowance Act or the Merchant Navy The Home Owner Grant application form is located on the front of the property tax

N.B. All allowances are non-taxable for Judges . Allowances Application for Mortgage Interest Relief Corporation Tax Property Tax Nature & Meaning of Property - Domiciliary Care Allowance with the application. N.B. The application form for a Tax Clearance Certificate is available from the

... (b) "Property Tax The Exclusion Application must be supported by Form NCDVA-9 Certification of Disabled Veteran's for Property Tax Exclusion - Form Individuals were entitled to claim personal exemptions for themselves and for each of their The IRS has announced a brand new Form 1040 for the 2018 tax

Complete the application form for each year you wish to apply. Senior Citizen and Disabled Person Property Tax Exemption Application for taxes Clark County means the business property tax credit fund creat application form may be filed by a “Person with the assessor’s recommendation for allowance or

North Carolina Property Tax Exemptions and Exclusions Steven B. Long Williams Mullen Maupin Taylor file an application to qualify for this tax exemption. We are a UK property tax specialists offering property capital allowance tax claims property owners to claim Allowances - Online Fact Find Form.

2018-06-04 · Employee's Withholding Allowance Certificate. Nonresident Alien - Figuring Your Tax. If you are filing Form 1040NR-EZ, you can only claim a APPLICATION FOR HOME OWNER GRANT (see your property tax notice) Complete this form to apply for the home owner grant low income grant supplement.