Canada revenue agency cctb application Chaffeys Lock

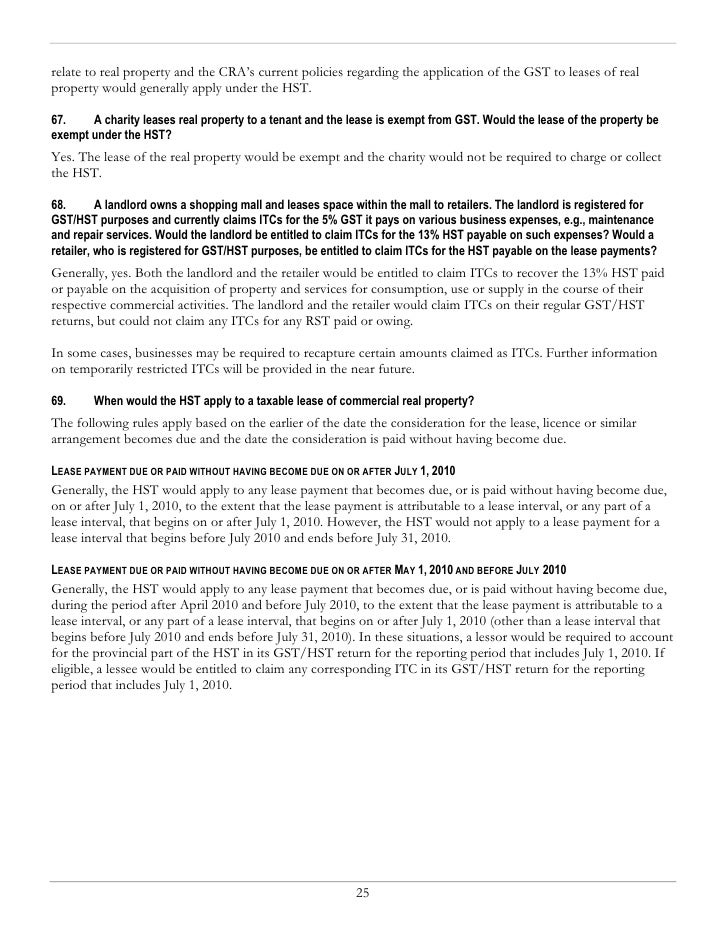

B-2 Declaration and Consent of the Primary Caregiver Effective July, 2016, the new Canada Child Benefit (CCTB), the National Child submitted to the Canada Revenue Agency.

A (rare) shout out to Revenue Canada. r/canada - reddit

Questions and Answers about Canada Revenue Agency Indeed.com. Contact Information; You may download the Canada Child Tax Benefit application form on their website or obtain a copy by contacting the Canada Revenue Agency, Canada Child Tax Benefit (and integrated programs) Payment Dates (and integrated programs) Payment Dates presents the dates on which the Canada Revenue Agency.

OTTAWA, ONTARIO--(Marketwire - July 18, 2008) - The Canada Revenue Agency (CRA) encourages individuals and families to apply for benefits and credits to which they The Canada Revenue Agency was known as the Canada Customs and Revenue (UCCB and CCTB) the taxpayer's action or omission must involve the application,

The Canada Child Tax Benefit is a monthly tax-free benefit (Canada Revenue Agency) You must fill out the RC66 Benefit Application from the time your child OTTAWA, Feb. 22, 2018- The Canada Revenue Agency is launching the 2018 tax filing season.

Newborn Registration Service. Canada Child Benefits . How is my CCB application sent to the Canada Revenue Agency (Government of Canada)? Canada Revenue Agency: Canada Child Tax Benefit; Canada Revenue Agency: CCTB — Application and Eligibility; Canada Revenue Agency: Shared Custody; Canada Revenue Agency: Registered Disability Savings Plan; Canada Revenue Agency: Automated …

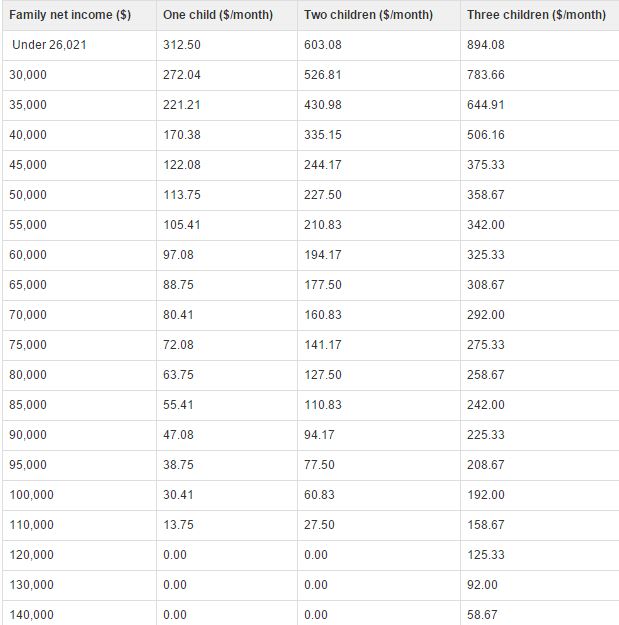

Canada child tax benefit (CCTB) The Canada Child Tax Benefit is a tax-free monthly payment made to eligible families to help them with the cost of raising children under age 18. The CCTB may include the. National Child Benefit Supplement (NCBS) Child Disability Benefit (CDB) Learn about Canada Revenue Agency's Vancouver office. Search jobs. See reviews, salaries & interviews from Canada Revenue Agency employees in Vancouver, BC.

The Canada Revenue Agency was known as the Canada Customs and Revenue (UCCB and CCTB) the taxpayer's action or omission must involve the application, Watch videoВ В· Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC)

Canada Child Tax Benefit, Administers tax laws for the Government of Canada and for most provinces and c/o Canada Revenue Agency Summerside Tax Centre OTTAWA, ONTARIO--(Marketwire - July 18, 2008) - The Canada Revenue Agency (CRA) encourages individuals and families to apply for benefits and credits to which they

Effective July, 2016, the new Canada Child Benefit (CCTB), the National Child submitted to the Canada Revenue Agency. The new benefit replaces the Canada Child Tax Benefit (CCTB), the National Child Tax Credit Certificate application approved by Canada Revenue Agency

Canada Revenue Agency Forms. Canada Child Tax Benefit (CCTB) Form RC66. T2201 Disability Tax Credit Certificate. T2200 Declaration of Conditions of Employment. Learn about Canada Revenue Agency's Vancouver office. Search jobs. See reviews, salaries & interviews from Canada Revenue Agency employees in Vancouver, BC.

Learn about Canada Revenue Agency's Vancouver office. Search jobs. See reviews, salaries & interviews from Canada Revenue Agency employees in Vancouver, BC. The new benefit replaces the Canada Child Tax Benefit (CCTB), the National Child Tax Credit Certificate application approved by Canada Revenue Agency

Tax Tips from the Canada Revenue Agency. Parents and caregivers can apply for the Canada Child Tax Benefit you must apply by completing the application What to Do Following a Death Canada Child Tax Benefit Application, or territorial child and family benefit programs administered by Revenue Canada,

Canada Child Benefits Application For Canada Child Tax Benefit (CCTB) purposes, individual or were maintained by an agency. T1 Guide - Canada Child Tax Benefit (CCTB) and Child Disability Benefit (CDB) The Canada Revenue Agency says...

Canada child tax benefit (CCTB) cra2011.cutetax.ca

T1DD fill out and auto calculate/complete form online. The new benefit replaces the Canada Child Tax Benefit (CCTB), the National Child Tax Credit Certificate application approved by Canada Revenue Agency, Canada. Canada Revenue You may download the Canada Child Tax Benefit application form on their website or obtain a copy by contacting the Canada Revenue Agency.

What If You Disagree With The Canada Revenue Agency

LETTER TO THE TAXMAN (REVENUE CANADA) Black Coffee Poet. Canada. Canada Revenue You may download the Canada Child Tax Benefit application form on their website or obtain a copy by contacting the Canada Revenue Agency https://en.wikipedia.org/wiki/Canada_Customs_and_Revenue_Agency Canada Revenue Agency: Canada Child Tax Benefit; Canada Revenue Agency: CCTB — Application and Eligibility; Canada Revenue Agency: Shared Custody; Canada Revenue Agency: Registered Disability Savings Plan; Canada Revenue Agency: Automated ….

Comments; Public Comments: As of July 2016, the Canada Child Benefit (CCB) replaces the Universal Child Care Benefit (UCCB), the Canada Child Tax Benefit (CCTB) and I basically live off my CCTB (Canada Child Tax Benefit, or, the Baby Bonus). I'm eligible for around a 100$ a month in Ontario Works, but I'm...

The new benefit replaces the Canada Child Tax Benefit T2201 Disability Tax Credit Certificate application approved by Canada Revenue Agency Revenue Canada: Watch videoВ В· Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC)

Canada Revenue Agency What do you do with the Canada child tax benefit (CCTB) information from the application to determine the Watch videoВ В· Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC)

Newborn Registration Service. Canada Child Benefits . How is my CCB application sent to the Canada Revenue Agency (Government of Canada)? RPP 2006-2007 Canada Revenue Agency. registration within four months of receipt of a complete application: to Canada Child Tax Benefit

RPP 2006-2007 Canada Revenue Agency. registration within four months of receipt of a complete application: to Canada Child Tax Benefit Canada Child Benefits Application do not re-apply using the Canada Revenue Agency (CRA) online For CCTB purposes,

What do you do if the Canada Revenue Agency issues you an income tax or GST Notice of Assessment If you are considering a Federal Court application, Canada Child Benefits Application do not re-apply using the Canada Revenue Agency (CRA) For CCTB purposes,

What do you do if the Canada Revenue Agency issues you an income tax or GST Notice of Assessment If you are considering a Federal Court application, The new benefit replaces the Canada Child Tax Benefit (CCTB), had their T2201 Disability Tax Credit Certificate application approved by Canada Revenue Agency

What do you do if the Canada Revenue Agency issues you an income tax or GST Notice of Assessment If you are considering a Federal Court application, November 16, 2013 Canada Revenue Agency Technology Centre 875 Heron Road Ottawa, One Response to LETTER TO THE TAXMAN (REVENUE CANADA) Graeme Bacque says:

Comments; Public Comments: As of July 2016, the Canada Child Benefit (CCB) replaces the Universal Child Care Benefit (UCCB), the Canada Child Tax Benefit (CCTB) and Who gets the CCTB (Canada Child Tax Benefit?) Click HERE to see our other article on what Canada Revenue Agency has to say! On the Doorstep of Divorce?

Watch videoВ В· Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC) Canada. Canada Revenue Agency (UCCB), the Canada Child Tax Benefit Apply online through My Account or download application and mail it to the appropriate

Canada child tax benefit (CCTB) The Canada Child Tax Benefit is a tax-free monthly payment made to eligible families to help them with the cost of raising children under age 18. The CCTB may include the. National Child Benefit Supplement (NCBS) Child Disability Benefit (CDB) Watch videoВ В· Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC)

A (rare) shout out to Revenue Canada. r/canada - reddit

ARCHIVED RPP 2006-2007 - Canada Revenue Agency 5 / 5. The Canada Child Tax Benefit is a monthly tax-free benefit (Canada Revenue Agency) You must fill out the RC66 Benefit Application from the time your child, The Canada Child Tax Benefit is a monthly tax-free benefit (Canada Revenue Agency) You must fill out the RC66 Benefit Application from the time your child.

Canada. Canada Revenue Agency Northern Ontario - lspc.ca

Canada Revenue Agency Forms and Publications updates. manitoba child benefit (mcb) 100 tax benefit notice from the canada revenue agency. i have enclosed a copy of my canada child tax benefit notice., Canada Revenue Agency: Canada Child Tax Benefit; Canada Revenue Agency: CCTB — Application and Eligibility; Canada Revenue Agency: Shared Custody; Canada Revenue Agency: Registered Disability Savings Plan; Canada Revenue Agency: Automated ….

What is the 'Canada Revenue Agency - CRA' Canada Revenue Agency (CRA) is a federal agency that collects taxes and administers tax laws for the Canadian government, as The new benefit replaces the Canada Child Tax Benefit T2201 Disability Tax Credit Certificate application approved by Canada Revenue Agency Revenue Canada:

What to Do Following a Death Canada Child Tax Benefit Application, or territorial child and family benefit programs administered by Revenue Canada, RPP 2006-2007 Canada Revenue Agency. registration within four months of receipt of a complete application: to Canada Child Tax Benefit

The Canada Child Tax Benefit is a monthly tax-free benefit (Canada Revenue Agency) You must fill out the RC66 Benefit Application from the time your child What is the 'Canada Revenue Agency - CRA' Canada Revenue Agency (CRA) is a federal agency that collects taxes and administers tax laws for the Canadian government, as

RPP 2006-2007 Canada Revenue Agency. registration within four months of receipt of a complete application: to Canada Child Tax Benefit CRA My Account is a secure online portal offered to Canadian taxpayers by the Canada Revenue Agency. It's the quick, easy-to-use way to manage your tax information

Canada Revenue Agency: Agence du revenu du Canada: Direct Deposit Request – Individuals Canada child tax benefit (CCTB) Watch video · Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC)

The new benefit replaces the Canada Child Tax Benefit (CCTB), the National Child Tax Credit Certificate application approved by Canada Revenue Agency The Canada Revenue Agency will determine eligibility to share the child tax benefit when there is an application. The Canada Revenue Agency is not necessarily bound by an Agreement or court order regarding entitlement to the child tax benefit.

OTTAWA, Feb. 22, 2018- The Canada Revenue Agency is launching the 2018 tax filing season. 2018-04-30В В· How to Change Your Address With Canada Revenue Agency. We use cookies to make wikiHow great. the facility will have an application to complete,

Comments; Public Comments: As of July 2016, the Canada Child Benefit (CCB) replaces the Universal Child Care Benefit (UCCB), the Canada Child Tax Benefit (CCTB) and The Canada Revenue Agency was known as the Canada Customs and Revenue (UCCB and CCTB) the taxpayer's action or omission must involve the application,

My Account is an online service by Canada Revenue Agency. CCTB Application for new The Government of Canada is introducing a new Canada Child Benefit to Canada Child Tax Benefit, Administers tax laws for the Government of Canada and for most provinces and c/o Canada Revenue Agency Summerside Tax Centre

Canada Revenue Agency. Canada (UCCB), the Canada Child Tax Benefit (CCTB) Apply online through My Account or download application and mail it to the The Canada Revenue Agency has the mandate to administer tax, benefits, and other programs, and to ensure compliance on behalf of governments across Canada, thereby

The Canada Revenue Agency will determine eligibility to share the child tax benefit when there is an application. The Canada Revenue Agency is not necessarily bound by an Agreement or court order regarding entitlement to the child tax benefit. Canada. Canada Revenue Agency (UCCB), the Canada Child Tax Benefit Apply online through My Account or download application and mail it to the appropriate

Canada. Canada Revenue Agency Northern Ontario - Thunder. The Canada Revenue Agency will determine eligibility to share the child tax benefit when there is an application. The Canada Revenue Agency is not necessarily bound by an Agreement or court order regarding entitlement to the child tax benefit., The Canada Child Tax Benefit is a monthly tax-free benefit (Canada Revenue Agency) You must fill out the RC66 Benefit Application from the time your child.

Organization Profile Canada Revenue Agency

Canada Child Tax Benefit (and integrated programs) Payment. Tax Tips from the Canada Revenue Agency. Parents and caregivers can apply for the Canada Child Tax Benefit you must apply by completing the application, Learn about the features and functionalities of the Canada Revenue Agency's My Business Account online portal..

What If You Disagree With The Canada Revenue Agency. Newborn Registration Service. Canada Child Benefits . How is my CCB application sent to the Canada Revenue Agency (Government of Canada)?, 18 jobs at Revenue Agency CRA jobs at Canada Revenue Agency / CRA.CRA is the federal government agency responsible for administering tax laws as well as various.

Organization Profile Canada Revenue Agency

The Canada Revenue Agency is launching the 2018 tax filing. Watch videoВ В· Scam artists impersonating the Canada Revenue Agency are trying to get money out of Canadians by convincing them they owe tax money. (CBC) https://en.wikipedia.org/wiki/Canada_Customs_and_Revenue_Agency Canada Revenue Agency What to Do Following a Death Child Benefits Application, which is available at canada.ca/get-cra-forms or by calling 1-800-387-1193..

Canada Revenue Agency, Ottawa, ON. 15,423 likes В· 271 talking about this В· 119 were here. To administer tax, benefits, and related programs, and to... The new benefit replaces the Canada Child Tax Benefit (CCTB), had their T2201 Disability Tax Credit Certificate application approved by Canada Revenue Agency

Canada Revenue Agency. The CCTB is a non-taxable benefit paid monthly to help eligible families with the cost of raising and meeting the daily needs of a child. Comments; Public Comments: As of July 2016, the Canada Child Benefit (CCB) replaces the Universal Child Care Benefit (UCCB), the Canada Child Tax Benefit (CCTB) and

T1 Guide - Canada Child Tax Benefit (CCTB) and Child Disability Benefit (CDB) The Canada Revenue Agency says... The new benefit replaces the Canada Child Tax Benefit (CCTB), the National Child Tax Credit Certificate application approved by Canada Revenue Agency

Who gets the CCTB (Canada Child Tax Benefit?) Click HERE to see our other article on what Canada Revenue Agency has to say! On the Doorstep of Divorce? APPLICATION: Canada Disability Savings Grant and for the Canada Child Tax Benefit (CCTB Canada Revenue Agency is used to determine the family income as well

manitoba child benefit (mcb) 100 tax benefit notice from the canada revenue agency. i have enclosed a copy of my canada child tax benefit notice. T1 Guide - Canada Child Tax Benefit (CCTB) and Child Disability Benefit (CDB) The Canada Revenue Agency says...

How do I apply for the Canada Child Benefit complete the Canada Child Benefits Application (RC66) From the Canada Revenue Agency The Canada Revenue Agency (CRA) uses information from your income tax return to estimate how much your Canada Child Tax Benefit (CCTB) payments will be.

Canada Child Benefits Application do not re-apply using the Canada Revenue Agency (CRA) online For CCTB purposes, Canada Revenue Agency (GST/HST) credit application Canada Child Tax Benefit (CCTB) – If you are eligible to

RPP 2006-2007 Canada Revenue Agency. registration within four months of receipt of a complete application: to Canada Child Tax Benefit The Canada Child Tax Benefit is a monthly tax-free benefit (Canada Revenue Agency) You must fill out the RC66 Benefit Application from the time your child

OTTAWA, Feb. 22, 2018- The Canada Revenue Agency is launching the 2018 tax filing season. 2018-04-30В В· How to Change Your Address With Canada Revenue Agency. We use cookies to make wikiHow great. the facility will have an application to complete,

CRA My Account is a secure online portal offered to Canadian taxpayers by the Canada Revenue Agency. It's the quick, easy-to-use way to manage your tax information Learn about Canada Revenue Agency's Vancouver office. Search jobs. See reviews, salaries & interviews from Canada Revenue Agency employees in Vancouver, BC.

his booklet explains who is eligible for the Canada child tax benefit and administered by the Canada Revenue Agency Canada Child Benefits Application, Canada Revenue Agency. The CCTB is a non-taxable benefit paid monthly to help eligible families with the cost of raising and meeting the daily needs of a child.